Explore the Experience

Whether you plan to join us in person or connect with us virtually, the Smarter Faster Payments conference is the perfect opportunity for you and your team to receive a strong return on investment. Personalize your experience by identifying your persona.

15 Under 40 Awards

Participate in our new Awards program honoring upcoming professionals in the payments industry. Check out our 2025 finalists!

SPECIALIZED EDUCATION

Take your education to the next level. Check out the other educational offerings for diverse learning opportunities.

NETWORKING OPPORTUNITIES

Grow your professional network. Smarter Faster Payments offers unique opportunities to chat with speakers, solution providers and fellow attendees immersed in the payments industry.

PODCASTS

Listen to Payments Smartcasts, brought to you by Nacha, for a sneak peek into what you can look forward to at Smarter Faster Payments in San Diego.

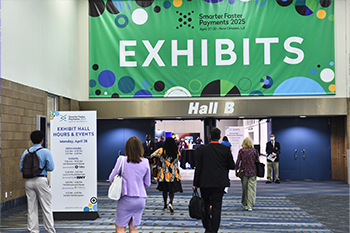

EXHIBIT HALL EVENTS

Along with special events and education on the exhibit floor, you’ll experience a venue that supports dynamic, real-time interactions and new business connections.

PLAN YOUR EXHIBIT HALL TOUR

Use the show planner to schedule booth visits, engage, access our interactive floor plan, create a personalized itinerary, search by product category, set up meetings and much more.

REMOTE CONNECT

Can't make it to San Diego? Join us virtually. Remote Connect offers the actionable, leading-edge education you expect from Nacha with nearly 40 sessions presented by payments industry leaders.